Continuation Candlestick Patterns

There are certain

useful patterns that indicate whether the current trend will continue or not is called continuation candlestick patterns. There are ten different continuation candlestick patterns, all of which can be used

to determine the longevity of current trends.

useful patterns that indicate whether the current trend will continue or not is called continuation candlestick patterns. There are ten different continuation candlestick patterns, all of which can be used

to determine the longevity of current trends.

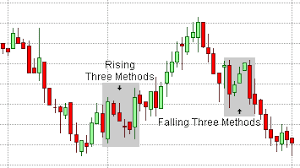

Rising Three Methods Pattern

The rising three methods pattern is a multiple-candle pattern. It’s a continuation

pattern that appears in an uptrend. It is usually depicted as consisting of five candles,

but this is not a requirement.

First, a long bullish candlestick appears in an uptrend, indicating strength on the

part of the bulls. This is followed by a series of small-bodied candles that move in

the opposite direction.

pattern that appears in an uptrend. It is usually depicted as consisting of five candles,

but this is not a requirement.

First, a long bullish candlestick appears in an uptrend, indicating strength on the

part of the bulls. This is followed by a series of small-bodied candles that move in

the opposite direction.

It is good if the small candles stay within the range of the first candle. This

series of small-bodied candles represents the bears fighting back, but they are only

able to muster a weak response against the powerful bulls.

The final candle in the pattern is a long bullish candlestick, which closes above

the highs of the previous candles in the pattern. Any traders who sold short when

the bears attempted to gain control are now losing money. The bears have been

defeated, and the price is now free to move higher.

The rising three methods pattern is similar in some ways to a bull flag, a

continuation chart pattern.

series of small-bodied candles represents the bears fighting back, but they are only

able to muster a weak response against the powerful bulls.

The final candle in the pattern is a long bullish candlestick, which closes above

the highs of the previous candles in the pattern. Any traders who sold short when

the bears attempted to gain control are now losing money. The bears have been

defeated, and the price is now free to move higher.

The rising three methods pattern is similar in some ways to a bull flag, a

continuation chart pattern.

Falling Three Methods Pattern

The falling three methods pattern is a multiple-candle pattern. It’s a continuation pattern that appears in a downtrend. It is usually depicted as consisting of five candles, but this is not a requirement. First, a long bearish candlestick appears in a downtrend, indicating strength on the part of the bears. This is followed by a series of small-bodied candles that move in the opposite direction. It is preferable if the small candles stay within the range of the first candle.

This series of small-bodied candles represents the bulls fighting back, but they are only able to muster a weak response against the powerful bears. The final candle in the pattern is a long bearish candlestick, which closes beneath the lows of the previous candles in the pattern. Any traders who went long when the bulls attempted to gain control are now losing money. The bulls have been defeated, and the price is now free to move lower. The falling three methods pattern is similar in some ways to a bear flag, a continuation chart pattern.

Bullish Mat Hold Pattern

This is a variation on the rising three methods pattern. It is basically the same as rising three methods with one exception. If the second candle of the rising three methods pattern (the first small body) gaps above the high of the first candle in the pattern, it is known as a ‘‘bullish mat hold pattern.’’

Otherwise, it is similar to the rising three methods pattern in both structure and psychology. Like rising three methods, the bullish mat hold consists of a strong bullish thrust, followed by a weak rebuttal by the bears, followed by yet another strong bullish thrust.

Bearish Mat Hold Pattern

This is a variation on the falling three methods pattern. It is basically the same as

falling three methods with one exception. If the second candle of the falling three methods pattern (the first small-bodied candle) gaps below the low of the first candle

in the pattern, it is known as a bearish mat hold pattern.

Otherwise, it is similar to the falling three methods pattern in both structure and

psychology. Like falling three methods, the bearish mat hold pattern consists of a

strong bearish thrust, followed by a weak rebuttal by the bulls, followed by yet

another strong bearish thrust.

falling three methods with one exception. If the second candle of the falling three methods pattern (the first small-bodied candle) gaps below the low of the first candle

in the pattern, it is known as a bearish mat hold pattern.

Otherwise, it is similar to the falling three methods pattern in both structure and

psychology. Like falling three methods, the bearish mat hold pattern consists of a

strong bearish thrust, followed by a weak rebuttal by the bulls, followed by yet

another strong bearish thrust.

Bullish Separating Lines

This two-candle pattern is significant within an uptrend. The first candle begins with

a gap higher, then fades to form a bearish red candle. A second candle then gaps

to the same opening price as the first, but then proceeds to move higher, in the

direction of the dominant trend.

Both candles have the same opening price but move in opposite directions—hence

the name ‘‘separating lines.’’ The bullish second candle completely negates any

bearish impact of the first candle. Any traders who sold short during the first candle

are now holding a losing position, and may be forced to cover. With these former

sellers effectively removed from the equation, the path of least resistance is higher.

a gap higher, then fades to form a bearish red candle. A second candle then gaps

to the same opening price as the first, but then proceeds to move higher, in the

direction of the dominant trend.

Both candles have the same opening price but move in opposite directions—hence

the name ‘‘separating lines.’’ The bullish second candle completely negates any

bearish impact of the first candle. Any traders who sold short during the first candle

are now holding a losing position, and may be forced to cover. With these former

sellers effectively removed from the equation, the path of least resistance is higher.

Bearish Separating Lines

This two-candle pattern is significant within a downtrend. The first candle begins

with a gap lower, but then the price rises to form a bullish green candle. A second

candle then gaps to the same opening price as the first, but then proceeds to move

lower, in the direction of the dominant trend.

Both candles have the same opening price, but move in opposite directions-hence

the name ‘‘separating lines.’’ The bearish second candle completely negates any

bullish impact of the first candle. Any traders who went long during the first candle

are now holding a losing position and may be forced to sell. With these former

buyers effectively removed from the equation, the path of least resistance is lower.

with a gap lower, but then the price rises to form a bullish green candle. A second

candle then gaps to the same opening price as the first, but then proceeds to move

lower, in the direction of the dominant trend.

Both candles have the same opening price, but move in opposite directions-hence

the name ‘‘separating lines.’’ The bearish second candle completely negates any

bullish impact of the first candle. Any traders who went long during the first candle

are now holding a losing position and may be forced to sell. With these former

buyers effectively removed from the equation, the path of least resistance is lower.

|

|

Bearish Separating Lines

|

Rising Window Pattern

In an uptrend, a new candle opens with a gap above the previous candle’s high. In

candlestick parlance, this gap is called a ‘‘window.’’ There are no overlapping wicks

or shadows in the window, as it is an area in which no trades have occurred. The

window itself acts as support in the event of a throwback.

candlestick parlance, this gap is called a ‘‘window.’’ There are no overlapping wicks

or shadows in the window, as it is an area in which no trades have occurred. The

window itself acts as support in the event of a throwback.

Falling Window Pattern

In a downtrend, a new candle opens with a gap beneath the previous candle’s low.

In candlestick parlance, this gap is called a ‘‘window.’’ There are no overlapping

wicks or shadows in the window, as it is an area in which no trades have occurred.

The window itself acts as resistance in the event of a pullback.

In candlestick parlance, this gap is called a ‘‘window.’’ There are no overlapping

wicks or shadows in the window, as it is an area in which no trades have occurred.

The window itself acts as resistance in the event of a pullback.

Bullish Marubozu

A bullish Marubozu is a single long candlestick with no upper or lower wicks that

acts as a continuation candle. The candle has opened at the low of the session and

moved in one direction until closing at the high of the session.

acts as a continuation candle. The candle has opened at the low of the session and

moved in one direction until closing at the high of the session.

Bearish Marubozu

A ‘‘bearish Marubozu’’ is a single long candlestick with no upper or lower wicks

that acts as a continuation candle. The candle has opened at the high of the session

and moved in one direction until closing at the low of the session.

that acts as a continuation candle. The candle has opened at the high of the session

and moved in one direction until closing at the low of the session.

This Marubozu candle tells us that the bears are firmly in control, and that the

price is likely to continue moving lower. The fact that the price is able to close on its

low shows a lack of willingness on the part of the bears to take profits. Why would

profitable bears be unwilling to take profits? Because they are acting on the belief

that there is more downside to come.

price is likely to continue moving lower. The fact that the price is able to close on its

low shows a lack of willingness on the part of the bears to take profits. Why would

profitable bears be unwilling to take profits? Because they are acting on the belief

that there is more downside to come.

Very nice